End January 24 Management Accounts

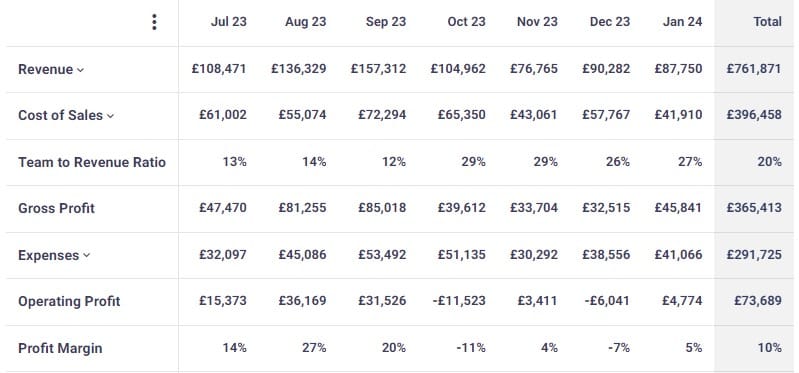

Please find below the management accounts to the end of January, with summary numbers above.

We have used new software to consolidate multiple organisations into a single profit and loss table, which is hopefully simple to understand. The organisations included are The Football Supporters Society of Bury (which includes Shakers Community Society and Bury FC Supporters' Society), Bury Football Club (2019) Ltd (which trades as Bury Football Club) and The Bury Football Club Company Ltd (which owns the Gigg Lane stadium). The revenue figures are slightly understated as we do not yet have a direct feed from the Bury FC Supporters' Society bank account into the software which will add around £1000 to the numbers.

The overall picture is positive, and the high level numbers are accurate. Management accounts are always a work in progress and individual lines of income and expenditure will change over time as we tidy the report up and add in new revenue and cost items. We have a number of areas which we want to assess in more detail as we believe they can be improved to give more accurate figures in real-time, especially where stock purchases or delays in receiving income payments are involved, such as food and beverage and merchandise which we suspect are more profitable than are currently shown.

Currently 'Other Income' includes interest earned and 'Other Expenses' includes depreciation. We are working with our auditors to finalise how we treat depreciation of the stadium, so these may change. We may need to provision for any Corporation Tax under 'Other Expenses' also. The auditors are also assisting with the balance sheet.

The management accounts consolidate all of these entities into one financial report. They show an operating profit of £74, 000 to the end of January. The contribution of each entity is:

Football Supporters' Society of Bury - £58k profit

Bury Football Club £63k - profit

The Bury Football Club Company Ltd - £47k loss

Losses have reduced in The Bury Football Club Company Ltd significantly in recent months. In the first three months of the financial year (July-September) the loss was £33k and in the last three months (November-January) it was just £3k. Some of this is due to seasonality, but we have also moved some costs into the football club, including salaried staff who have replaced paid external contractors.

The team costs include management and non-playing football staff not just players, and cover all the men's first team, women's first team and the new under 23s men's team.

Membership income remains strong. We had 1927 active paying subscriptions as at 15th February, although we only send one email per email address and this will include some duplication across the memberships. We expect this number to reduce as we continue to gradually move members across to the new FSSB membership and remove duplicate memberships, which is an ongoing process.

Our margin has reduced in recent months as a result of fewer home games, especially Saturday home games, and these have mostly been caused by weather related postponements. Poor weather, even where games do take place, reduce crowd sizes and secondary spend in the stadium, as does moving to a Tuesday night. We expect these to improve again in the spring. Cash reserves remain strong despite ongoing investment in the stadium and the inevitable depletion of season ticket funds.

We hope to make an announcement about our plans for the installation of a 3G pitch by March. This is well progressed and we are finalizing the funding required for the installation, having agreed the technical specification and business plan which should ensure it is a success. The manager and his team provided their insight into their preferences for the playing surface to ensure it meets with their approval. In addition to more revenue from pitch rental fees we expect to drive some more food and beverage revenue as the stadium become more used during the week, if we can get the pitch installation funded. We have a good understanding of what is required to secure the funding, and will share full details on this soon.

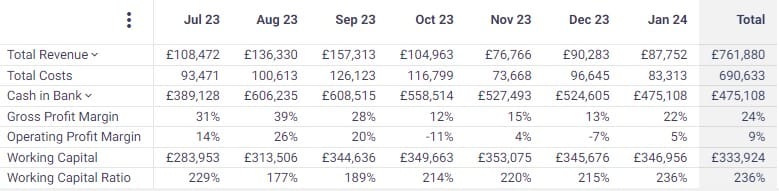

We have also produced the above Key Financial Metrics as a snapshot of our financials.

Working capital is current assets less current liabilities. Our aim is to keep the working capital ratio over 150% where possible. Persistently remaining below 100% would be cause for concern, accepting there may be short term reasons for this.